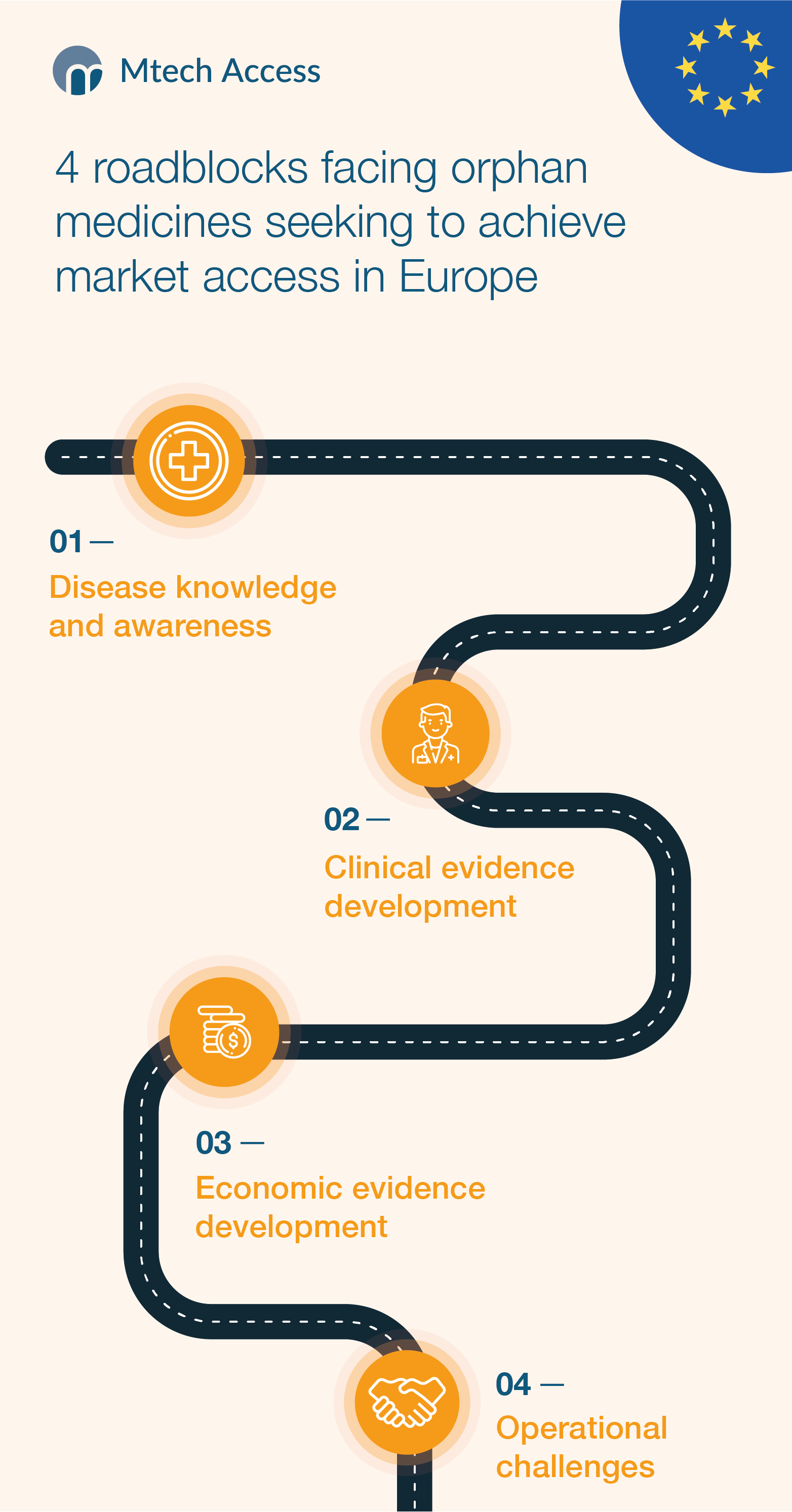

In this four-part series, we explore the various challenges facing orphan medicines entering the European market and suggest solutions that can help improve patient access. In the final part of the series, we explore the operational challenges of bringing an orphan drug to the European market.

Orphan medicines reimbursement cost the health systems of EU member states about €20–25 billion between 2000 and 2017. This was in addition to the EU and national public funding invested in research.1 Such high costs, downstream of regulatory incentives, create national and local access challenges which are bottlenecks to fulfilling the promise of addressing the needs of rare disease patients across EU countries.

The market access journey for orphan medicines is complex. Nevertheless, more companies, both large and small, are entering the rare diseases market. Worldwide orphan drug sales are forecast to grow at a compound annual growth rate of 12.3% from 2019 to 2024, which is approximately double the rate forecast for the non-orphan drug market.2

Interestingly, smaller biotech/pharma organisations are overrepresented on the list of the top 20 orphan R&D products (Phase 3) in the pipeline (forecasted sales), whereas larger pharmaceutical companies tend to develop these assets at a later stage, after company acquisition or in-licensing strategies.

At Mtech Access, we are excited to be in a position to support companies looking to launch their orphan medicines in Europe, some of whom may be embarking on this journey for the first time. In this final article, I look at the operational challenges such companies may face when launching into the European market.

Operational challenges

Launch planning and preparation is especially challenging for orphan medicines, whose manufacturers can face the following hurdles:

- Given the low number of patients, a wide geographic dispersal often means there are fewer medical staff and resources than for other disease areas. For example, patients from several regions or even neighbouring countries may be treated at one or two specialist treatment centres. On the other hand, the prevalence of certain rare diseases, especially genetic diseases, may be significantly greater in particular regions or countries than in others, which may justify prioritising staff and resources to those areas. Manufacturers may even plan to launch in those countries first, even if they are typically not their priority markets.

- Engagement with payers, clinicians, and patient organisations is crucial to ensure optimal patient access at launch, particularly with rare diseases due to the disease awareness and clinical challenges discussed in the previous articles of this series. However, manufacturers need to navigate legal and ethical hurdles in planning for these interactions. Failure to comply with best practices may result in significant damage to a company’s reputation, as has happened with some past orphan medicine launches.

- The high price/value often associated with these medicines further exposes manufacturers to increased public scrutiny.

- Finally, manufacturers need to map and navigate different national and subnational HTA processes and requirements.

Solutions to improve patient access

International collaboration and HTA is becoming more relevant and can support manufacturers looking to launch a new orphan medicine. For example, EUnetHTA, which has now published several assessments in high-cost disease areas, provides an assessment shortly after regulatory approval, thus pooling resources, setting evidence standards, and accelerating assessments and access to patients in several geographies. With the associated geographical dispersal, legal, and ethical hurdles and reputation risk, development of a thoughtful and coordinated engagement plan is perhaps more crucial than in other disease areas, as it is key to align regional and affiliate strategy and incentives with broader global strategy coordination.

Furthermore, manufacturers need to anticipate and address potential funding gaps, predicted through engagement with national, regional, and local funding bodies. For example, manufacturers can participate in horizon scanning consultations, improve forecasting, and look to create innovative payment mechanisms to address budget impact concerns. Early access programmes, conditional licensing, and managed entry agreements can all support progressive patient access. Registry-linked real-world data collection can in turn address payer concerns around clinical and economic uncertainty. For example, recent orphan medicine launches have offered retroactive rebates, deferred payments and instalment options, and outcomes-based/pay-for-performance contracts.

Finally, manufacturers can proactively engage with public bodies looking to address challenges related with orphan medicine access through public-private partnerships. For example, companies or their partners have collaborated with public health bodies in the prevention, detection, and diagnosis of rare diseases.3

If you’d like to discuss these topics with us and would like to hear more about how we can help you overcome your current challenges in a rare disease area, please email info@mtechaccess.co.uk to arrange a meeting with one of our experts.

References:

- European Comission. Joint evaluation of Regulation (EC) No 1901/2006 of the European Parliament and of the Council of 12 December 2006 on medicinal products for paediatric use and Regulation (EC) No 141/2000 of the European Parliament and of the Council of 16 December 1999 on orphan medicinal products 2020.

- Orphan Drug Report 2019. https://www.evaluate.com/thought-leadership/pharma/evaluatepharma-orphan-drug-report-2019 Accessed on: January 2021

- Department of Health and Social Care. The UK Strategy for Rare Diseases: 2019 Update to the Implementation Plan for England. 2019. Available from: https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/781472/2019-update-to-the-rare-diseases-implementation-plan-for-england.pdf. Accessed on: January 2021

[…] Read Part 2: Clinical evidence development Read Part 3: Economic evidence development Read Part 4: Operational Challenges […]

[…] Read Part 1: Disease knowledge and awareness Read Part 2: Clinical evidence development Read Part 4: Operational Challenges […]